Join us December 21, 2023 at the Tea Tree Asian Bistro (YUM!!) at 4100 Chappel Dr., Perrysburg, OH where you will learn about the 5 A’s of customer service, presented by Linda Werts, CPP.

Join us for November’s Chapter Meeting

Our next meeting is November 16, 2023 – this will be a virtual meeting. You can join the meeting from the comfort of your workplace or home. In your pajamas or work wear. Michael Schoelles, CPP is our speaker.

Michael is a payroll director at Bright Horizons and was the Payroll Man of the Year with Payroll Org. He is skilled at Tax Reporting · Strategy Execution · Strategic Thinking · Garnishments · Reporting Requirements · Presentations and Operational Excellence therefore is the perfect person to talk to us about process mapping and its importance in the payroll workspace.

Click HERE to register for the meeting.

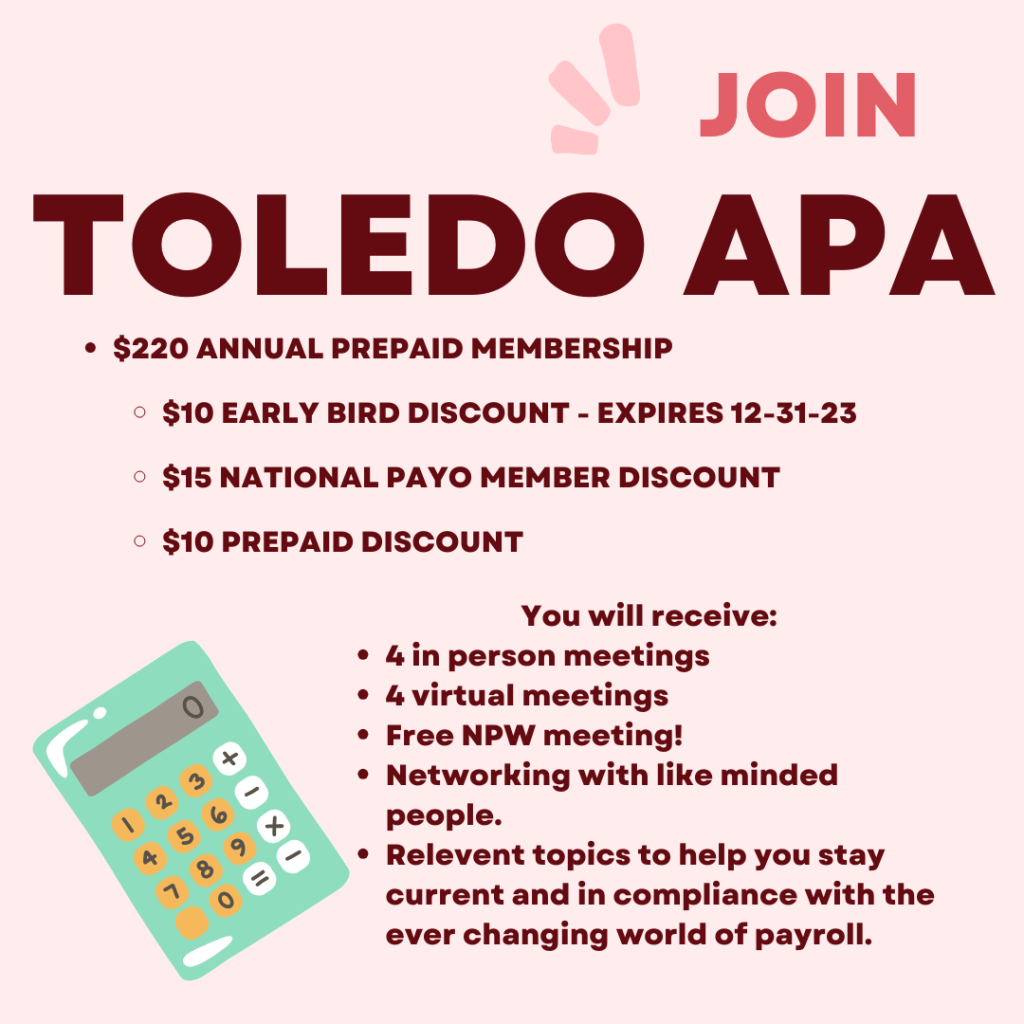

Don’t miss a thing! Join us in 2024

Take advantage of prepaid membership (other membership option are available) in 2024. Watch your email for the link.

Secure Act 2.0

On December 23, 2022, Congress passed the Securing a Strong Retirement Act of 2022 (Secure 2.0) as part of the Consolidated Appropriations Act of 2023, which President Biden signed into law. This Act will require many changes to your retirement plans and options.

A new category of catch-contributions is being introduced in 2025. Employees aged 50 or older the receive the standard increase in catch-up contribution of $7,500. The catch-up limit for employees aged 60-63 will be the greater of $10,000 or 150% of the standard catch-up limit and they increase each year with inflation.

Today, employees can choose to deposit catch up contributions in either pre-tax accounts or after-tax Roth accounts but in 2024 employees who whose compensation is more than $145,000 all catch up contributions must be deposited into a Roth account.

One of the biggest impacts to Secure 2.0 legislation is 401(k) automatic enrollments. Employers starting new plans will have to automatically enroll participants in a 401(k) with a default contribution rate of 3% and an annual increase of 1% until they reach 10%. If the employee does not want this, then they will be required to proactively opt out. Small businesses with 10 or fewer employees will be required to utilize automatic enrollment in 2025.

Thanks to Secure 2.0, employees will be able to withdraw up to $1,000 without penalty as an emergency distribution and the option to repay the distribution within three years. Employees will not be able to take out any other distribution within that three-year period until the original withdrawal is repaid.

Big student loan payments keep many workers from being able to save for retirement. Secure Act 2.0 allows employers to consider student loan payments as elective retirement contributions for the purpose of making employees eligible for matching contributions. Employers will still be able to put an employer matching contribution on the employee’s behalf.

To read on for more information and understand the dates at which these changes are in effect visit The CPA Journal here or review the legislation text here.

Membership is FREE!

Who doesn’t like Free? This year the Toledo Chapter of the APA is offering everyone the opportunity to stay informed and relevant, stay connected and driven and learn new things along the way – ALL FOR FREE!

Join HERE to become a member!

Don’t get left out on a chance for free membership – we cannot guarantee that non members will continue to receive emails and updates. Be sure to send to your colleagues – make sure they know too!

PayTalk Podcast

PayTalk is a monthly podcast created by the American Payroll Association (APA) and the Global Payroll Management Institute (GPMI) with the goal of sharing earned knowledge from high-level payroll professionals to the greater industry at large. Join us each month as we take a look at the leaders behind the payroll processes. Whether you’re just starting out in payroll or are a seasoned professional, PayTalk will help uncover the insights needed to unlock the next stage of your career.

Learn more HERE

SSA to Change How to Access BSO on March 25

On March 25, the Social Security Administration (SSA) is changing how to sign up for and access Business Services Online (BSO) accounts [BSO, Alert, 3-20-23]. The change will affect users of Wage File Upload, W-2 Online, W-2c Online, AccuWage Online, and the Social Security Number Verification Service (SSNVS).

For more information visit the American Payroll Association website HERE.